Port Clinton Income Tax

2022 State of the City Address

March 10, 2022

Income Tax Department Extended Hours for Filing 2022 Income Tax Returns

April 5, 2022Port Clinton Income Tax

The following are required documents to be included in your tax packet when filing a City Income Tax Return. If you packet does not contain all the items, the return will be sent back to you. We do not hold any returns.

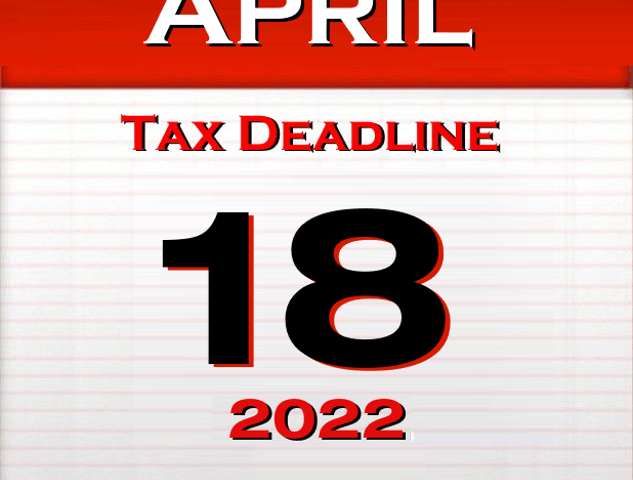

Failure to submit ALL required documents on or by April 18, 2022 will result in your return being late and being subject to penalties and interest. If taxes and/or estimates are due, your payment is required at time of filing. Otherwise penalties and interest may apply.

- Completed and Signed City Income Tax Return

- Phone Number and Email are required

- Social Security Numbers are required

- Copies of all W2s, W2Gs, 1099s, Etc.

- Copy of your Federal Income Tax Return (1040, 1065, 1120, 1120s, and ALL Schedules, Statements & Explanations, including any K-1s and 1099s issued.

- Make sure to include all pages. The 1040 and most schedules are 2 pages. If any page is missing, the return will be sent back.

- Payment of Taxes Due

- Estimated Payment for Tax Year 2022 if required.

- If tax liability is $200 or more, taxpayers are required to make estimated payments